For one, it can help you optimize your cash flow and increase your working capital. Automating your accounts receivable can also help reduce the administrative burden of managing it, such as sending automated reminders, invoicing, and tracking payments. Accounts payable is a current liability on the balance sheet, while accounts receivable is a current asset.

These programs not only simplify the accounts receivable process but also yield valuable insights through real-time reporting and data analytics. Proper revenue recognition allows businesses to accurately monitor their financial performance, manage resources, and make informed decisions about pricing, production, and growth. When recording accounts receivable, you want to post the revenue in the month you earn it. This will keep your accounting records accurate and consistent with accrual accounting. When it comes to facilitating payments, providing multiple options is paramount. This approach ensures that customers can make payments even when their authorized personnel are unavailable due to travel or other commitments.

Streamline cash flow management

It involves a range of tasks like onboarding new customers, evaluating their creditworthiness, issuing invoices on time, and timely collection specific features of work with cash accounting in bookkeeping of payments. The formula to calculate accounts receivable is typically the sum of all outstanding invoices owed to the company by its customers. It can also be calculated using the Accounts Receivable Turnover Ratio, which is net credit sales divided by the average accounts receivable balance during the period. This ratio helps measure the efficiency of the company’s credit and collections practices. In recent years, the use of accounting software for managing financial processes has grown in importance. This software facilitates the seamless handling of various accounting tasks, including journal entries and maintenance of the general ledger.

“Receivable” refers to fact that the business has earned the money because it has delivered a product or service but is, at that point in time, still waiting to receive the client’s payment. First, ensure that invoices are sent out promptly and in line with agreed payment terms. Establishing a consistent invoice delivery schedule prompts customers to anticipate and prepare for on-time payments.

Set and stick to your credit policies

This section outlines the prominent legal and ethical factors that businesses need to consider while handling accounts receivable. In conclusion, the integration of cutting-edge technology in accounting software and process automation has led to significant advancements in the accounts receivable landscape. Embracing these innovations can yield substantial benefits, from improved efficiency and accuracy to enhanced cash flow and customer satisfaction.

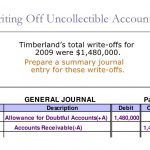

Most businesses operate on credit, but when you sell goods on credit, there’s always a risk that some customers may miss the due date, fail to pay the invoice and affect your cash flow. Accountants and auditors also find the aging of accounts to determine a reasonable amount to be reported as bad debt expense and to establish a sufficient balance in the allowance for doubtful accounts. For any business that sells goods or services on credit, effective accounts receivable management is critical for cash flow and profitability planning and for the long-term viability of the company. Receivables management begins before the sale is made when a number of factors must be considered. Another reason, accounts receivables are one of the key sources of cash inflow and given the volume of credit sales, a large amount of money gets tied-up in accounts receivables. This simply implies that so much of money is not available till it is paid.

More payment options

- A typical aging schedule groups invoices by their number of days outstanding, such as 0-30 days, days, days, and over 90 days.

- Whenever a customer delays in paying invoicing, a business faces a lot of cash flow and liquidity problems, resulting in financial issues and working capital shortages.

- Although it looks very simple on the face of it, Managing receivables from Debtors can be a very complex task depending on the nature of our business.

- Quality should encompass not only the products or services you provide but also the quality of customer interactions at every stage of engagement.

Accounts receivable represent funds owed to a company and are booked as an asset. Accounts payable, on the other hand, represent funds that a company owes to others and are booked as liabilities. HighRadius offers powerful, cloud-based Order to Cash software to automate and streamline financial operations. Establishing effective two-way communication is vital, both internally and externally. This may seem like an obvious factor, but it is often ignored, especially when it comes to the finance team and customers.

It helps you how much does a small business pay in taxes track, monitor, and on-time action on overdue/long-pending bills resulting in an increased inflow of cash that is essential for business growth. By implementing the right strategies, businesses can improve their accounts receivable management process and minimize issues, such as bad debts, late payments, and outstanding invoices. Managing accounts receivable effectively is essential for ensuring the long-term success of a business by maintaining working capital and minimizing bad debt. By utilizing tools like an aging schedule and implementing a systematic collections process, businesses can better manage their receivables, ensuring timely payments and strong cash flow.

In a survey, 90% of the respondents agreed that collecting Sales Receivables is bigger challenge than Sales itself. In Accounting terms Our Customers who owe us money are called as “Sundry Debtors”. If working capital is lifeline of the Business, then Managing the Accounts receivables is soul of working Capital.

Company

In contrast, accounts should you really buy stocks now or wait a while longer payable (AP) is the money a company owes to its suppliers for goods or services received but not yet paid for. In essence, AR is an asset, representing incoming funds, while AP is a liability, representing outgoing funds. A good accounting system with tools for managing invoice accounts receivable can help you get paid faster, so you can focus on running your business.